My strategy for investing in undervalued stocks

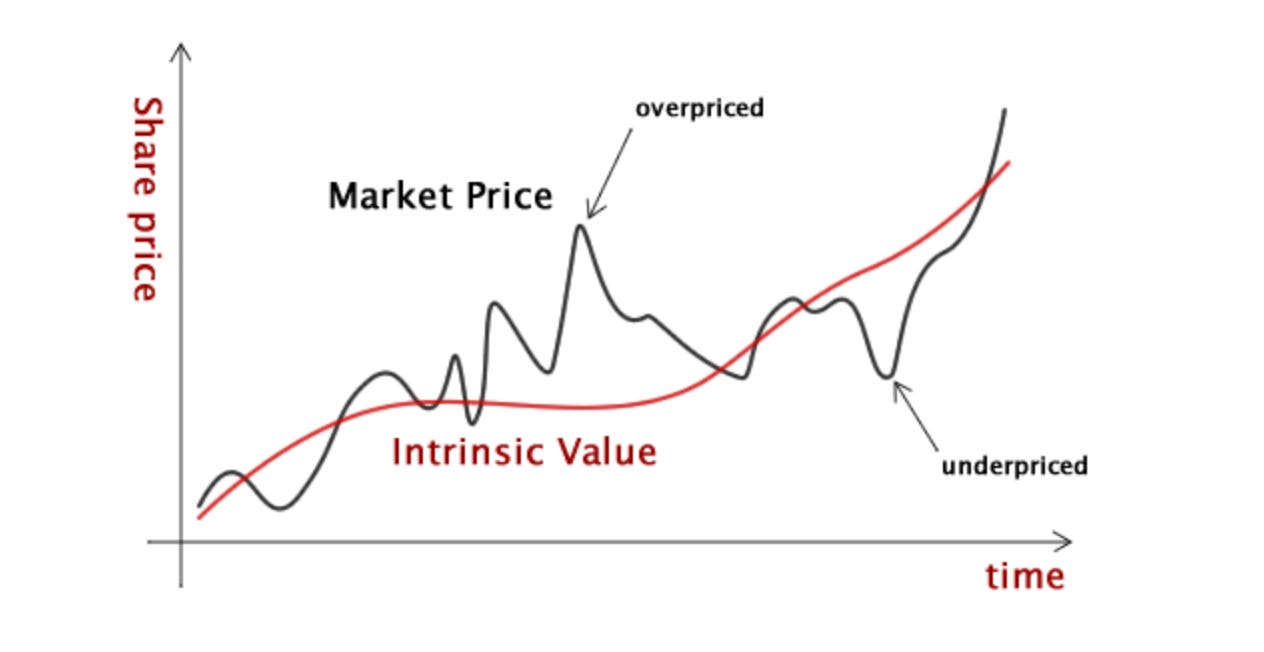

One of the key things I’ve learned so far is that investing in undervalued businesses requires a lot of patience.

Most undervalued investments take time to materialize.

Some stocks take three years, five years, or even ten years.

There’s no way to know exactly “how long” a stock will return to it’s intrinsic value.

Because of that, patience is the most important trait when investing in undervalued businesses, along with being disciplined about when to deploy capital.

In the meantime, it makes sense to keep capital working by investing in coupon bonds, dividend stocks, or, from my experience, the broader market through ETFs, so it can generate returns. As the market grows, one can slowly take profits and redeploy that capital into undervalued stocks when opportunities arise.

This approach allows me to stay invested at all times while gradually reallocating capital in a way that generates bigger returns over the long term - by adding on to undervalued positions.

I can benefit from market gains, take profits at certain points, and then use that cash to invest in undervalued businesses. By repeating this process, I can build a sustainable investment strategy that maximizes my exposure to undervalued opportunities while remaining disciplined and patient by staying in the market.

With that, I will leave you a quote from Ken Fisher: