The Economics of Decentralized GPU Networks

Today’s post comes from a discussion with the founders of Bitsage Network. I also learned a lot about the fundamental engine of AI technology - the GPU networks that provide the computing power AI needs to operate.

Modern technologies, combined with AI, are enabling decentralized compute networks where anyone can contribute by connecting their home GPU.

To understand how these networks operate, we need to know how validators, GPUs, utilization, and capital investment interact over time.

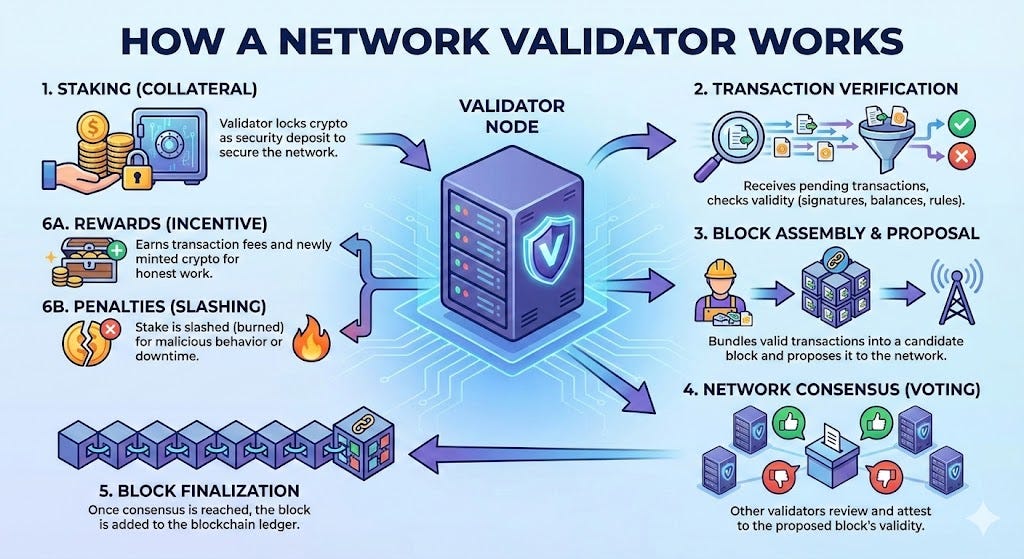

What is a validator?

At the core of a decentralized GPU network is a validator.

A validator is not a “user” in the traditional sense. It’s best thought of as:

A GPU node connected to the network

A provider of computation

An entity incentivized through token rewards

If you’ve ever looked at Bitcoin mining, the analogy is close, but instead of hashing blocks, validators provide real GPU computation and submit proofs that the work was done correctly.

This matters because capacity comes before demand.

You cannot serve customers without available GPUs. There is no abstraction layer that changes this reality.

Validators come first. Customers follow.

One of the most important insights is simple but often misunderstood:

Validators must exist before customers can scale.

The network grows in parallel, but the order matters:

Validators join and provide GPUs

The network gains capacity

Customers can now use that capacity

If the network has 100 GPUs, it can serve roughly 100 customers concurrently. You cannot grow beyond your available compute supply.

This makes validator growth the primary leading indicator of network growth.

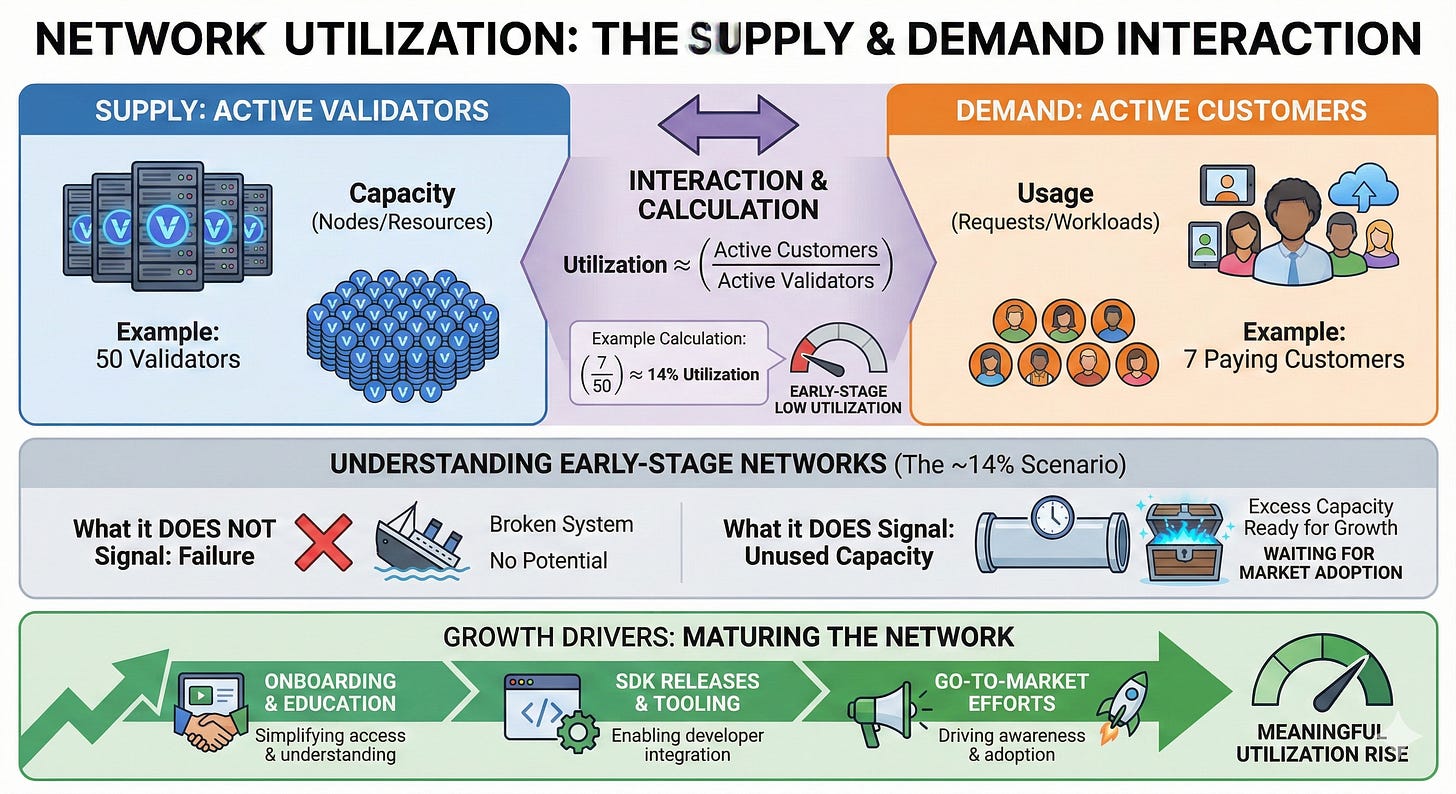

Network utilization

Utilization is often misunderstood as a single number. In reality, it’s the interaction between:

Active validators (supply)

Active customers (demand)

Early-stage networks often show low utilization, and that’s normal.

For example:

50 validators

7 paying customers

→ ~14% utilization

This does not signal failure. It signals unused capacity waiting for market adoption.

Utilization only rises meaningfully after onboarding, SDK releases, and go-to-market efforts mature.

Compute growth and its constraints

Decentralized compute markets grow fast—but not infinitely.

There are real constraints:

GPUs are physical assets

Global GPU supply is finite

Validator onboarding takes time

When modeling growth, it’s tempting to extrapolate exponential curves indefinitely. That’s how unrealistic projections appear (millions of validators in short timeframes).

How capital actually changes network dynamics

Capital enables:

Validator incentives

Marketing and community growth

Liquidity provisioning

Infrastructure and operations

In decentralized networks, capital injections often correlate with temporary acceleration, not permanent growth rates.

This creates a recognizable pattern:

Spike after funding

Gradual normalization

Stable long-term growth

Modeling this correctly prevents overstating future adoption.

Expense structure mirrors technical maturity

Another key lesson: expenses should follow product maturity.

Early stage:

Heavy core development

High R&D intensity

Minimal marketing

Mid stage:

Development stabilizes

Operations and compliance appear

Validator onboarding ramps

Growth stage:

Go-to-market becomes dominant

Partnerships and ecosystem expansion accelerate

R&D focuses on defensibility (e.g., cryptography, privacy, ZK proofs)

Flattening expenses across time hides this reality and distorts cash flow analysis.

Competitive context matters

Decentralized GPU networks don’t exist in isolation.

Major players in this space include:

Many of these projects reached multi-billion-dollar valuations—but none started there. Early rounds were often small, focused on proving:

Technical feasibility

Validator demand

Early utilization

The pattern is consistent: validate first, scale later.

Decentralized GPU networks are not magic

Decentralized GPU are systems governed by:

Physical hardware constraints

Incentive alignment

Capital timing

Network effects

Understanding validators, utilization, and growth mechanics is far more important than tracking token prices or headline metrics.

If you get those fundamentals right, everything else becomes easier to reason about.